10 Best Real Estate Niches For Realtor

The real estate niche refers to a specific segment or specialization within the broader real estate industry. It represents a focused area of expertise or a particular market segment that real estate professionals, investors, or businesses choose to specialize in. By narrowing their focus, individuals or organizations can gain a deeper understanding of a specific market, its dynamics, and its unique challenges and opportunities. The real estate niche refers to a specific segment or focus within the broader real estate industry. Real estate itself encompasses various activities related to the buying, selling, renting, and development of properties, including residential, commercial, and industrial real estate. Within this vast industry, niche markets have emerged, catering to specific types of properties, clients, or specialized services.

Real estate encompasses a wide range of properties, from residential homes to commercial buildings, luxury estates to affordable housing, and urban apartments to rural landscapes. This diversity allows individuals to find properties that align with their preferences and requirements, making it an exciting and dynamic niche.

Real estate deals with physical assets that have a lasting impact. Unlike other investment vehicles, such as stocks or cryptocurrencies, real estate properties are tangible and provide a sense of permanence. Owning a property and watching it grow and evolve can be incredibly rewarding.

Real estate has long been recognized as a wealth-building tool. Investing in properties can provide both short-term and long-term financial benefits. Property owners can generate passive income through rentals, benefit from property appreciation, and leverage their assets to acquire additional properties. Real estate has the potential to create a robust financial portfolio and secure a prosperous future. Real estate plays a crucial role in shaping communities. Development projects can revitalize neighbourhoods, create job opportunities, and contribute to local economies. Real estate developments, such as mixed-use spaces, walkable neighbourhoods, and green initiatives, have the power to transform areas and enhance the quality of life for residents.

Real estate provides an excellent avenue for diversifying investment portfolios. It offers an alternative asset class that can offset risks associated with other investments, such as stocks and bonds. Diversification helps spread risk and enhance long-term financial stability.

READ ALSO » Top 10 Most Profitable Niches On YouTube

Overall, the beauty of the real estate niche lies in its diversity, tangibility, wealth creation potential, architectural aesthetics, community impact, emotional connections, adaptability, and investment opportunities. These aspects make real estate a captivating and rewarding industry to explore and participate in.

Here are the 10 best Niche in Real Estate:

- Luxury real estate

- Commercial real estate

- Vacation Rental Properties

- Green/Sustainable Real Estate

- Real Estate Investment

- Historic Properties

- Senior/Retirement community

- Farm and Ranch Real Estate

- Real Estate development

- Waterfront properties

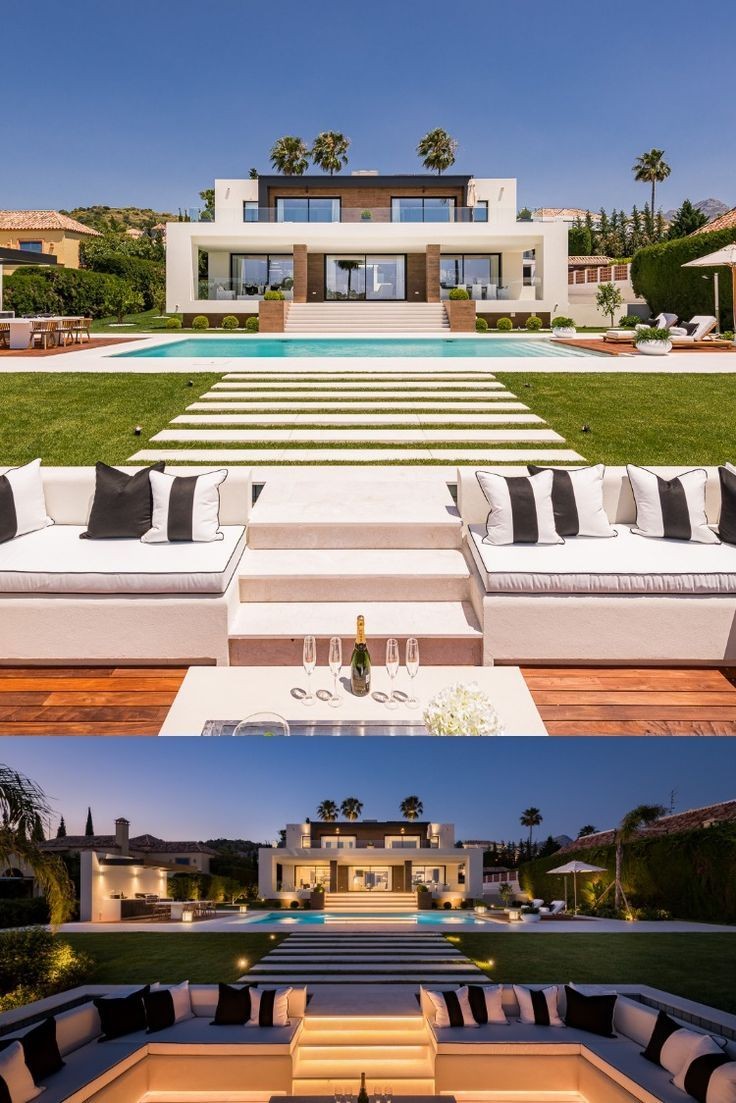

Luxury Homes:

This niche focuses on high-end properties that offer luxurious amenities, breathtaking views, and exquisite designs. These homes often cater to the wealthy and feature elements like private pools, spa facilities, and high-tech smart home systems.

Also, refer to high-end properties that offer exceptional quality, design, and amenities, catering to the affluent and discerning buyers. These homes are characterized by their lavishness, exclusivity, and a range of luxurious features and finishes. Luxury homes typically have a larger square footage compared to standard homes and are located in prestigious neighborhoods or desirable locations such as waterfronts, gated communities, or scenic areas.

Features and amenities commonly found in luxury homes include spacious floor plans, high ceilings, high-end architectural designs, premium materials and finishes, top-of-the-line appliances, custom-made furnishings, smart home technology, private outdoor spaces, swimming pools, spa facilities, home theaters, wine cellars, and extensive landscaping.

Luxury home buyers often seek privacy, security, and breathtaking views. They may also value proximity to high-end amenities such as golf courses, upscale shopping districts, fine dining establishments, and cultural or recreational facilities.

The prices of luxury homes can vary significantly based on factors such as location, size, architectural design, quality of finishes, and the overall prestige of the property. In many markets, luxury homes are considered investments that can appreciate over time, attracting buyers looking for both a luxurious lifestyle and a potential return on investment.

Vacation Rentals:

This niche involves properties specifically purchased or designed for short-term rentals to vacationers. These properties are located in desirable vacation destinations and are equipped with amenities like private pools, beach access, and entertainment facilities to attract tourists.

READ ALSO » 10 Best Gifts For Realtor

A vacation rental, also known as a holiday rental or short-term rental, is a type of accommodation that is rented out to travelers on a temporary basis. It is a popular alternative to hotels and resorts, especially for those looking for more space, privacy, and a home-like experience during their vacation or travel.

In real estate, vacation rentals refer to properties that are owned by individuals or investors and are specifically designed and furnished for short-term stays. These properties can include houses, apartments, villas, cabins, or even unique accommodations such as treehouses or yurts. They are typically located in tourist destinations or popular vacation spots, such as coastal areas, ski resorts, or urban centers with significant tourist traffic.

Owners of vacation rentals advertise their properties on various platforms, including online travel agencies, vacation rental websites, and booking platforms. Travelers can browse through these listings, view property details, check availability, and make reservations for a specific period of time. Vacation rentals can be rented for a few days, weeks, or even months, depending on the traveler's needs and the property's availability.

The benefits of vacation rentals include more space and privacy compared to hotel rooms, fully equipped kitchens that allow guests to cook their own meals, and often amenities such as swimming pools, hot tubs, or outdoor spaces. Vacation rentals can be a cost-effective option for families or groups traveling together as they can often accommodate more people at a lower cost per person than multiple hotel rooms.

However, it's important to note that regulations and laws surrounding vacation rentals can vary by location. Some cities or jurisdictions have specific rules and restrictions on short-term rentals, including licensing requirements, taxes, and zoning regulations. It's crucial for both property owners and travellerss to understand and comply with these regulations when engaging in vacation rental activities.

Commercial Real Estate:

This niche involves properties used for commercial purposes, such as office buildings, retail spaces, or industrial facilities. Investors in commercial real estate seek properties with high potential for rental income and long-term capital appreciation.

Commercial real estate refers to properties that are used for business purposes or income generation. It includes various types of properties such as office buildings, retail spaces, industrial warehouses, hotels, and multifamily apartment buildings. These properties are typically bought, leased, or rented out by individuals, companies, or investors for commercial activities.

READ ALSO » 10 Things I Wish I Knew Before I Became A Realtor

Commercial real estate differs from residential real estate, which is used for personal living purposes. The primary objective of commercial real estate is to generate income through rental or lease payments, capital appreciation, or operating a business on the property.

Investing in commercial real estate offers potential benefits such as steady cash flow, long-term appreciation, tax advantages, and diversification of investment portfolios. Commercial properties are often valued based on their income-generating potential, with factors such as location, tenant quality, lease terms, and market conditions influencing their value.

Commercial real estate transactions can involve various parties, including property owners, investors, tenants, brokers, lenders, and property managers. The leasing and sale of commercial properties are governed by specific contracts and regulations that differ from those in residential real estate.

Overall, commercial real estate plays a crucial role in the economy by providing spaces for businesses to operate, contributing to job creation and economic growth.

Green/Sustainable Real Estate:

Green or sustainable real estate refers to the practice of developing, constructing, and operating buildings in an environmentally responsible and resource-efficient manner. The goal of green real estate is to minimize the negative impact of buildings on the environment and promote a more sustainable and healthier living environment for occupants.

Green real estate encompasses various aspects, including design, construction, energy efficiency, water conservation, waste management, indoor air quality, and the use of environmentally friendly materials.

This niche emphasizes environmentally-friendly properties and sustainable practices. It involves promoting energy-efficient homes, LEED-certified buildings, and eco-friendly communities. Green real estate focuses on environmentally friendly properties and sustainable building practices. This niche involves promoting energy efficiency, renewable resources, and eco-friendly design features. Investing in green buildings can attract environmentally conscious tenants and generate savings on operating costs.

Real Estate Investment:

REITs allow investors to pool their money to invest in a diversified portfolio of real estate properties. This niche offers an opportunity to invest in real estate without direct property ownership.

This niche focuses on helping investors find profitable real estate opportunities. It involves analyzing market trends, identifying undervalued properties, and providing guidance on investment strategies. Real estate investment focuses on acquiring properties for the purpose of generating income or capital appreciation. This niche involves understanding market trends, evaluating investment opportunities, and managing rental properties or flipping houses for profit.

Historic Properties:

This niche deals with properties of historical significance. It involves preserving and restoring historic homes, working with historical societies, and understanding local preservation regulations.

This niche focuses on preserving and selling historic homes or properties with significant historical value. It requires knowledge of preservation regulations, restoration techniques, and historical property appraisal.

This niche includes restored mansions, heritage-listed buildings, and properties located in historic districts. Investors in historic properties aim to preserve the historical integrity while updating the properties to meet modern living standards.

In the real estate niche, historic properties refer to buildings or sites that have significant historical, cultural, or architectural value. These properties are typically recognized and protected by government entities or preservation organizations to ensure their preservation and safeguard their historical importance.

Historic properties can include various types of structures, such as houses, commercial buildings, churches, schools, museums, and even entire districts or neighborhoods. They may date back to different periods, ranging from colonial times to more recent historical eras.

The value of historic properties lies in their unique characteristics, which can include distinctive architectural styles, craftsmanship, materials, and historical associations. They often serve as landmarks that contribute to the identity and cultural heritage of a region. Preserving these properties is important for maintaining a sense of history, providing educational opportunities, and attracting tourism.

When dealing with historic properties in real estate, there are specific considerations and regulations to take into account. Depending on the jurisdiction, owners of historic properties may need to adhere to strict preservation guidelines and obtain permits before making alterations or renovations. These regulations are in place to ensure that the historical integrity of the property is maintained while allowing for its adaptive reuse and continued functionality.

Historic properties can offer unique opportunities for real estate investors and buyers who appreciate the charm, character, and historical significance of these structures. However, it is essential to be aware of the responsibilities and limitations that come with owning or developing a historic property, as well as the potential costs associated with maintenance and restoration efforts.

Senior/Retirement Communities:

![The Number One Real Estate NICHE [Most Agents Overlook!]](https://teamboma.com/member/boma/ckeditor/uploads/pic/6b317ee062c534eccde0a56e6858dc22.jpg)

As the population ages, the senior living niche has gained prominence. It includes retirement communities, assisted living facilities, and nursing homes designed to provide specialized care and amenities for older adults.

These properties prioritize accessibility, safety features, medical services, and social activities tailored to seniors' needs. Investors in this niche contribute to meeting the growing demand for senior housing options. Senior housing caters to the needs of aging populations, including independent living communities, assisted living facilities, and nursing homes. This niche requires understanding the unique requirements and preferences of seniors and their families.

With an aging population, this niche focuses on properties tailored for seniors. It involves working with retirement communities, assisted living facilities, and understanding the unique needs of older adults.It includes retirement communities, assisted living facilities, and nursing homes. This sector requires understanding the needs of older adults and the regulations governing senior housing.

Farm and Ranch Real Estate:

This niche specializes in agricultural properties such as farms, ranches, and rural land. It requires knowledge of farming practices, land use regulations, and rural property management.

Farm and ranch real estate refers to properties that are specifically designed or used for agricultural purposes. These properties are typically larger in size and are intended for activities such as farming, ranching, livestock raising, or other agricultural endeavors.

Farm real estate usually consists of arable land suitable for cultivating crops or growing fruits, vegetables, or other agricultural products. These properties may also include irrigation systems, barns, storage facilities, and other structures necessary for agricultural operations.

Ranch real estate, on the other hand, primarily focuses on livestock raising and grazing. Ranch properties often encompass vast areas of land where cattle, horses, sheep, or other animals can graze and roam. They may feature facilities like barns, corrals, and fences to manage and support livestock activities.

Farm and ranch real estate can be found in both rural and semi-rural areas, depending on the region and local zoning regulations. These properties are typically bought and sold by individuals, families, or organizations involved in agricultural businesses or those seeking a rural lifestyle.

Real Estate Development:

Real estate development refers to the process of acquiring, improving, and constructing properties for various purposes, such as residential, commercial, industrial, or mixed-use projects. It involves a range of activities aimed at transforming raw land or existing buildings into valuable real estate assets.

Real estate development typically begins with identifying potential opportunities in the market, including vacant land, underutilized properties, or properties with redevelopment potential. Developers conduct feasibility studies to assess the viability and profitability of a project, considering factors such as market demand, zoning regulations, financial analysis, and environmental impact.

Once a viable opportunity is identified, the developer acquires the necessary land or property rights through purchase or lease agreements. They then proceed with the design and planning phase, which involves hiring architects, engineers, and other professionals to create detailed site plans, blueprints, and construction documents.

After obtaining the required permits and approvals from relevant authorities, the construction phase begins. This involves managing contractors, overseeing the construction process, and ensuring that the project is built according to the approved plans and specifications.

Real estate developers often collaborate with financial institutions or investors to secure funding for the project. They may use a combination of equity financing (investor contributions) and debt financing (loans) to cover the costs of land acquisition, construction, and other expenses associated with development. Once the project is completed, the developer may choose to sell or lease the developed property to end-users, such as homeowners, businesses, or tenants. Alternatively, they may retain ownership and manage the property as an ongoing investment, generating rental income or selling individual units over time.

Real estate development requires a multidisciplinary approach, involving expertise in finance, market analysis, urban planning, construction management, legal matters, and project management. Developers must navigate various challenges and risks, including market fluctuations, regulatory hurdles, construction delays, and changing consumer preferences.

Successful real estate development projects can have significant economic and social impacts, revitalizing neighborhoods, creating job opportunities, and contributing to the overall growth of a community

Real estate development involves acquiring land or existing properties and transforming them into new developments. This niche requires expertise in market analysis, construction, and project management. Real estate developers create residential communities, mixed-use complexes, commercial centers, and other large-scale projects, shaping the urban landscape and meeting the demand for new properties.

This niche involves the acquisition, planning, and construction of new properties. It requires expertise in land development, zoning regulations, project management, and working with architects and contractors. Real estate development involves purchasing land, obtaining permits, and overseeing the construction of residential or commercial properties. This niche requires knowledge of zoning regulations, construction processes, and project

Waterfront Properties:

This niche focuses on properties located near lakes, rivers, oceans, or other bodies of water. It involves understanding waterfront regulations, flood zones, and marketing the unique lifestyle associated with waterfront living. This niche revolves around properties located near bodies of water, such as lakes, rivers, or the ocean. It caters to clients looking for waterfront views, beach access, and water-related activities. Waterfront properties refer to real estate properties that are located along the waterfront, such as lakes, rivers, oceans, or other bodies of water. These properties are highly sought after due to their scenic views, access to water-based activities, and the potential for a luxurious lifestyle.

Waterfront properties can vary in terms of size and style, ranging from small cottages or cabins to grand estates. They may include features such as private docks, boat slips, beach access, or other amenities that enhance the enjoyment of the water.

The value of waterfront properties is often influenced by factors such as the size and quality of the waterfront, proximity to urban areas or amenities, environmental regulations, and the overall desirability of the location. Waterfront properties tend to command premium prices compared to similar properties located further inland.

These properties can serve as primary residences, vacation homes, or investment properties. Many people are attracted to waterfront living for recreational purposes, such as boating, fishing, swimming, and enjoying water sports. The tranquil and picturesque setting of waterfront properties also appeals to those seeking a peaceful and relaxing lifestyle.

However, it is important to note that owning waterfront property may come with additional considerations and challenges. Factors such as erosion, flood risk, and specific zoning regulations may impact the use and development of the property. Potential buyers and owners of waterfront properties should be aware of these factors and take them into account when making decisions about purchasing or developing such properties.

These real estate niches offer specialized opportunities for professionals to focus their expertise and cater to specific markets. Each niche requires a deep understanding of the unique dynamics, trends, and challenges associated with the respective real estate sector.