Economics Past Questions And Answers

3281

Money could be defined as

- A. Options A, B and C

- B. Medium of exchange

- C. Settlement of debt

- D. Medium of payment

3282

Development planning focuses mainly on

- A. allocation of resources by the entrepreneurs

- B. mapping out strategies by the government

- C. developing some areas of the country by the government

- D. deciding on which types of homes to build

3283

The economic questions about what and how to produce in an economy is solely answered by the _______?

- A. government

- B. labour union

- C. private and public enterpriser

- D. system of economy practised

3284

Economics may be defined as ________

- A. The study of human behaviour in the allocation of scarce resources

- B. The study of money and banking

- C. The study of markets and prices

- D. The study of production and distribution

3285

A tax that takes an increasing fraction of income as income goes down is called?

- A. conditional

- B. regressive

- C. progressive

- D. proportional

3286

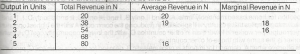

Determine the marginal revenue if the total revenue is 80.00

- A. 6.00

- B. 12.00

- C. 14.00

- D. 18.00

3287

Which of the following business units can issue shares?

- A. Partnership

- B. Public limited liability company

- C. Sole proprietorship

- D. Central bank

3288

Mr. Patrick’s income is N900 while that of Mr. Shodawe is N1,300. if Mr. Patrick and Shodawe pay N90 and N130 as taxes, the tax system is

- A. Direct

- B. Progressive

- C. Regressive

- D. Proportional

3289

The main feature of regressive taxation is that its rate

- A. is higher when income is higher

- B. is equal tax for all categories of people

- C. remains constant when income increases

- D. reduces when income increses

3290

Given that TR is total revenue, then TRn -TR (n-1) can be used to find the

- A. marginal revenue

- B. marginal cost

- C. average cost

- D. average revenue