The Top 10 Most Profitable Strategy In The World Now

Currency prices change every second, so predicting a forex pair's future direction without a strategy is unlikely to work in the long run.

As a result, the various forex trading strategies that are appropriate for traders of all skill levels will be reviewed and ranked in this guide.

The following is a list of the top ten forex strategies that will be used in 2023. These strategies are suitable for both novice and experienced traders alike.

10 Best Forex Strategies to Use in 2023

- Fibonacci Flush – Identify Potential Entry and Exit Orders

- MACD – Pinpoint Possible New and Ending Trends

- Bollinger Bands – Points of Support and Resistance

- Moving Average Crossovers – Discover Potential Changes in Direction

- Bladerunner – Shows Disparity Between Indicator and Current Market Price

- Momentum Indicator – Recognize Overbought or Oversold Pairs

- Parabolic SAR – Identify Potential Short-Term Reversal Points

- Relative Strength Index – Market Momentum Indicator

- The Pivot Point – Showcases Supply and Demand Levels

- Stochastic Oscillator – Recognizes Potential Trend Reversals

Find out more about each forex strategy and how to use them with our top-rated forex broker, eToro, in the following paragraphs.

A comprehensive explanation of the aforementioned top forex strategies is provided for traders below in Best Forex Strategies Reviewed.

READ ALSO » ASUU STRIKE: Education Is Now A Side Hustle

As we discussed, many traders employ multiple strategies simultaneously.

This guide goes on to explain how to select forex strategies that are suitable for particular trading objectives.

1. The Fibonacci flush

The Fibonacci Flush method can be utilized by forex traders to locate concealed levels of support and resistance for the placement of entry, exit, and stop orders. Traders who want to buy or sell during a strong trend frequently use this indicator.

Traders can confidently identify the current trend by examining the support and pullback levels. When trading the market's most volatile forex pairs, some traders employ the Fibonacci Flush strategy.

This strategy can also be used by swing and pullback traders, long-term investors, and scalers. This is because the Fibonacci strategy can be heavily modified to take advantage of both short-term momentum and longer plays.

When two or more time periods are taken into consideration, the Fibonacci retracements ratios become more apparent. Market timers may benefit from combining daily and weekly charts, but swing traders may benefit more from daily and 60-minute charts.

The alignment of significant Fibonacci levels over a number of time frames reveals hidden support and resistance in both instances. As a result, this is thought by some traders to be the best forex strategy for consistently making money. Just above the Fibonacci level that has been identified, a stop order will be placed.

2. MACD

READ ALSO » Top 5 Technologies That Will Change The World

dentify Beginning and Ending Trends. The MACD is a trend-following indicator. A momentum indicator would include something like this. To verify shifts in momentum, a signal line with a 9-day exponential moving average is added to the forex pair's chart.

When the MACD line crosses above the signal level, a buy order is typically considered. On the other hand, selling pressure may be necessary if the MACD line crosses below the signal line. 12, 26, and 9 are some of the most frequently utilized moving averages for intraday traders.

MACD forex strategy, on the other hand, swing traders typically use the 5, 13, and 1 moving averages. Scalpers, on the other hand, might select 4-hour or hourly charts. Naturally, the period chosen depends on the strategy and the individual.

However, this method and the exponential moving average (EMA) are utilized by numerous traders to locate entry points. To put it simply, traders use the MACD and an EMA to identify uptrends and downtrends and market volatility. One of the best ways to identify bullish and bearish momentum in forex trading is with this method.

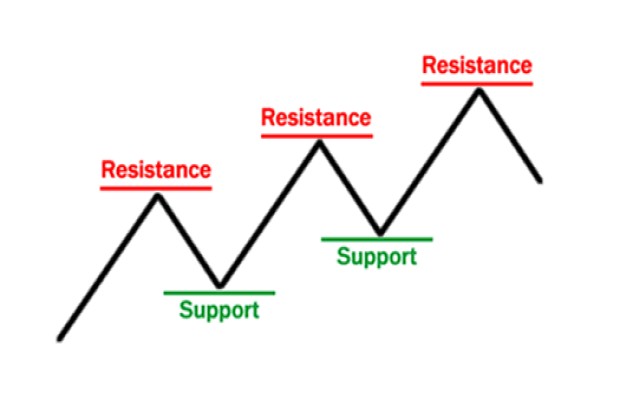

3. Support and resistance

points can be found using Bollinger Bands, which may be the most efficient forex trading strategy. When the Bollinger squeeze occurs, the bands begin to narrow, which frequently indicates that a breakout is about to occur.

As soon as the candles begin to break out above the upper band, the move will frequently continue to rise on a graph. If candles begin to break out below the bottom band, then the price is more likely to continue falling.

Price volatility is measured by the Bollinger Bands channel width. To put it another way, when a forex pair's price experiences a series of significant changes, the breadth of the Bollinger Bands increases.

On the other hand, the channel narrows when only a few price changes occur, as shown at 20:30 on the chart above. When the price consistently tests or breaks through one of the upper or lower bands, momentum is extremely strong.

4. Moving average crossover

READ ALSO » ASUU STRIKE: WHO LOOSE MOST AMONG FG, ASUU AND STUDENTS

The best forex trading strategy for spotting potential changes in direction is moving average crossovers. These crossovers are used to identify potential changes in direction. Identifying patterns like probable trend movements, potential entry points, and the possibility of a reversal can be made easier for traders by this.

When the shorter-term or fast-moving average crosses above or below the longer-term or slow-moving average at a particular point on a chart, this is known as a moving average crossover.

When trading moving average crossings, the timing of one's entry and exit is the central focus of the majority of these forex strategies.

The straightforward method of moving average crossover gave crossovers such names as Death Cross. The shorter-term moving average crosses below a longer-term trend in this instance. The Golden Cross, which occurs when a shorter-term moving average crosses above a longer-term trend, is another illustration.

Entering a trade with a clearly defined risk-reward ratio is a common forex strategy for novices. When a forex pair has a history of trending, for example, traders can position a stop-loss order above or below the crossing level.

5. The Bladerunner strategy

employs candlesticks, pivot points, support/resistance levels, and basic price movement in addition to the indicator and the current market price. Researching when and how to use the necessary indicators and charts is a big part of finding successful forex strategies.

Before using the Bladerunner strategy, traders should ensure that the market is trending. This forex trading strategy can make use of both a 20-period EMA and the middle line of the Bollinger Band indicator.

We have chosen to use the EMA to view the EUR/USD 5-minute chart in the image below.

bladerunner forex It is generally accepted that a price will soon fall when it is above the EMA. In contrast, it is assumed that it will soon rise when it is below the EMA. The term signal candle refers to the first candlestick that touches the EMA.

The confirmatory candle is the second candle that moves away from the EMA. Forex traders may place orders at this level in order to profit from the rising price.

6. Momentum Indicator

How to Identify Overbought or Oversold Pairs The momentum indicators measure the velocity of price changes. The algorithm of this price indicator compares a closing price from any time frame to the most recent one.

As a result, this is one of the best forex strategies for identifying currencies that may be oversold or overbought.

Momentum Indicator A momentum indicator is an oscillator because the resulting curve oscillates between the centerline and 100. The rate of price change is indicated by the distance between the indicator line and 100.

Overbought and oversold conditions are probably about to occur when the curve reaches its maximum or minimum value.

7. Parabolic SAR

Traders frequently employ the parabolic SAR (Stop and Reverse) to identify potential short-term reversal points. The best forex strategy for predicting currency momentum in the short term is this one. On the asset's chart, the parabolic SAR indication appears as a series of dots either above or below the price (as shown below), depending on the asset's momentum.

A small dot is placed below the price of the forex pair when the trend is upward, and one is placed above it when the trend is downward.

A move above the parabolic SAR indicates a reversal, causing the trader to anticipate a change in direction. Setting a trailing stop-loss order at the SAR value is a common forex strategy.

As we discussed, the most effective forex trading strategies employ multiple indicators simultaneously. The parabolic SAR, for instance, is compatible with the moving average, the ADX, and/or the stochastic oscillator.

8. Market Momentum Indicator

Relative Strength Index (RSI) The relative strength index (RSI) measures the speed and magnitude of recent price changes. As a result, this forex strategy is one of the easiest to evaluate market momentum. On the chart below, a line graph called an oscillator with a scale of 0 to 100 represents the RSI.

The RSI has additional capabilities in addition to determining assets that are overbought or oversold. It can be used as a cue for buying and selling. The RSI may also indicate currencies that are on the verge of a price fall or a change in trend.

Relative Strength Index (RSI) A reading of 70 or higher typically indicates an overbought situation. A value of 30 or lower indicates an oversold state. Using EMAs that respond more quickly to recent price changes can be advantageous.

The 5-day EMA crossing over the 10-day EMA is one example of one of the most useful indicators to use in conjunction with the RSI.

9. The Pivot Point

Shows the Levels of Supply and Demand This forex trading strategy shows the levels of the supply-demand balance between two currencies. There is equal supply and demand for that particular pair when the price reaches the pivot point. A greater demand for a particular currency pair is indicated when price movements cross the pivot point level.

On the other hand, price fluctuations that fall below the pivot point level indicate that there is more supply for that particular currency pair. As a result, pivot points can also be used to identify support and resistance zones.

The Pivot Point could be the best forex strategy for consistent profits if used correctly. For instance, pivot points can be determined by day traders using daily data. Swing traders have the option of utilizing weekly data to identify pivot points as well.

A position trader buys an investment and keeps it for a long time in the hope that its value will rise. Instead, traders can make use of data at the beginning of each month.

The RSI oscillator and pivot points, among other things, can be used together.

10. Stochastic Oscillator

The stochastic oscillator is one momentum indicator that analysts and traders use to anticipate future reversals. The stochastic oscillator is one of these indicators. This is one of the best forex strategies for spotting trend reversals as a result.

Range is measured by the stochastic oscillator rather than price or volume. By comparing the most recent closing price to the range for a specific time period, this can be accomplished.

A common time frame is 14 days, though it can be altered to meet specific analytical needs.

Stochastic Oscillator A stochastic oscillator is one that is range-bound, meaning that it is always between 0 and 100. As a result, it's a useful indicator of overbought and oversold conditions.

Deducting the period's low from the current closing price is how the stochastic oscillator is calculated. After that, it is divided by the entire period's range and multiplied by 100.

On a stochastic oscillator chart, the three-day simple moving average and the actual value for each session are typically represented by two lines. It is thought that the intersection of these two lines may point to an impending reversal.