Top 10 Best Loan App In Nigeria 2024

Many Nigerians are looking for loan apps in Nigeria that will give them quick loans to deal with their personal or professional issues. You can be looking for loan apps as a feasible answer because you're having financial problems and might need instant cash assistance.

There are a number of loan apps that can assist you in Nigeria if you need a loan right away. By examining the top 10 loan apps in Nigeria as of 2024, you can make the best decision.

Best loan App In Nigeria 2024

- Branch

- Carbon Loan app

- FairMoney

- Aella Credit

- QuickCheck loan app

- PalmCredit

- MIGO

- Lendigo SME loans

- Quick Credit

- MoneyPal

1. Branch

The Finest Mobile Loan App to Get Low Interest Rates

In Nigeria, Branch is a well-known lending platform that is well-known for its lightning-fast loan approval process and incredibly low interest rates.

Branch has streamlined the loan application procedure by minimizing the quantity of documentation required. Just download the app, register, submit an application for a loan, and wait for approval to apply for one.

READ ALSO » Top 10 Best Ways To Practice Gratitude Everyday

Making an account is a quick and easy process. All you have to do is supply your national ID number, bank account information, and phone number.

This app has received over 5 million downloads and a high rating of 4.6 stars on the Google Playstore, indicating its popularity. The interest rates on the loans offered by this lending organization range from 3% to 21% each month, or 15% to 34% annually. Rollovers and late payments are not subject to penalties.

All you need to do is download and install the mobile app from the Play Store, then follow the on-screen directions. See the Branch review for additional information and facts.

2. The Carbon Loan App

Carbon, a financial firm, is developing into a full-featured digital banking platform and is currently ranked among the top 20 loan apps in Nigeria. Future success is expected to increase as a result of this transformation. More than merely financial availability is offered by carbon. It further solidifies its position as a comprehensive financial platform for its users by providing a wide range of financial services such investments, fund transfers, airtime purchases, and bill payments.

Carbon's website will let you obtain a loan without requiring collateral or guarantors.

Over time, if you pay all of your bills on schedule, your credit score will increase and you'll be able to apply for larger loans. A repayment plan for the interest paid will also be provided if the loan is repaid on schedule.

The finest loan app now available in Nigeria for iPhone and Android is the Carbon (Peller) Loan App since it allows you to do all of your business using the app and allows you to monitor your credit right from the app. As someone who understands technology well, I can confirm that the application has the best possible design and development.

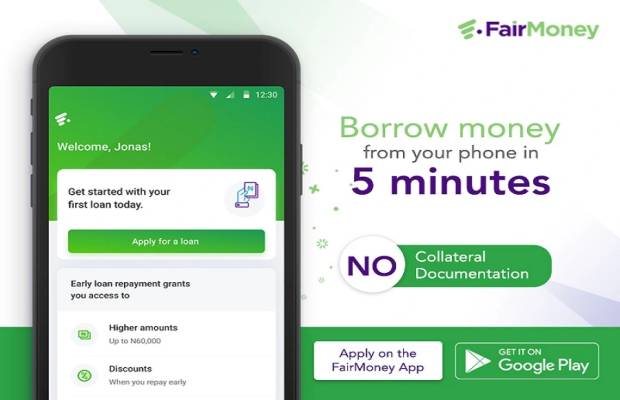

3. FairMoney

READ ALSO » Top 8 Best Strategies To Unlock Your True Self

One of the top 10 loan applications in Nigeria, FairMoney Fairmoney, provides rapid loans with amounts ranging from N15,000 to N1,000,000 at interest rates that vary from 2.5% to 30% monthly, or a 30% annual percentage rate (APR). To 260% and beyond.

Borrowers can apply for instant loans through FairMoney, which functions as a digital bank. You are not required to give any kind of collateral when using FairMoney.

With FairMoney, you can also choose to divide your repayments into multiple installments, giving you greater freedom and simplifying the usage of the available tools and services.

4. Aella Credit

Use the Aella Credit Loan App to find the best loan application option available. This innovative platform offers unmatched simplicity and speed in the borrowing process by streamlining it with the use of mobile devices and cutting-edge technologies.

Bid farewell to laborious paperwork and protracted wait times. You may apply for a loan with Aella Credit in a matter of minutes, and you'll have the money you need in five. The easily navigable application may be found on the Google Play Store and is available anywhere.

With Aella Credit, you can enjoy hassle-free borrowing with no additional fees for extended repayment terms or late payments.

Take advantage of flexible terms, including one million dollar loans, interest rates between 6% and 20%, and one to three month repayment terms.

This alternative eases the application procedure for loans and allays any fears or anxiety that the prospective borrower may have, therefore it makes sense to include it on our list.

5. QuickCheck loan app

READ ALSO » Top 10 Best Way To Stay Motivated While Learning Coding

Nigerian consumers can apply for loans quickly and easily with the QuickCheck smartphone app. From the comfort of your smartphone, QuickCheck allows you to apply for and get loans of up to 200,000 naira promptly sent to your bank account.

QuickCheck is different from other loan apps in part because of its dedication to the security and privacy of its users.

Modern encryption technology is used by QuickCheck to safeguard your personal data, and it never sells or distributes it with outside parties. The adaptable repayment choices offered by QuickCheck are another distinctive feature. You have the option of paying back your loan in full in one month or in installments over a maximum of twelve months. Because of this, QuickCheck is an excellent choice for anyone with a variety of financial demands.

6. PalmCredit

Nigeria-based fintech startup Newage Finance Limited provides loans and other financial services, including the PalmCredit lending app.

Due to its reasonable interest rates and flexible loan repayment durations, PalmCredit Loan App ought to be among the top 10 fast loan applications available in Nigeria.

The next-biggest app we've discussed so far that enables loan borrowing in Nigeria is called PalmCredit. You can obtain a loan for any amount between N2,000 and N100,000 using the Palmcredit app. You can borrow N2,000 at the very least.

7. MIGO

With the help of the embedded lending platform Migo, companies may provide credit lines to both small and individual customers through their own mobile applications. Small businesses and customers alike receive this service from enterprises themselves. It doesn't require the provision of any paperwork or collateral.

Without the need to complete any paperwork, you can have your loan in a couple of minutes. The interest rate you have will go raised if you pay off your loan early, meaning that the next time you borrow money from the platform, you will get paid more.

Migo has committed to offering a forty billion naira loan. A Mogo loan could have an interest rate of between 5% and 15%.

The maximum amount that you can borrow from Migo as a new customer is N50,000. This is true even if the maximum loan amount you may obtain with a Migo loan code is N450,000.

All you need is your mobile device, bank details (such your bank verification number), and an accurately completed and filed loan request form. To obtain a loan quickly, use the Migo Loan Code.

8. Lendigo SME loans

With this tool, getting a loan for your business in Nigeria may be completed in a matter of minutes.

You are authorized to borrow up to NGN10,000,000, provided it has been established that your organization meets the requirements for low-interest loans.

It is an effective instrument for applying for startup loans since it gives small and medium-sized business owners quick, easy, and adaptable access to funding that meets their specific needs. It also performs all of this in an individualized way.

9. Quick Credit

With Quick Credit, consumers can get quick cash to meet their financial and banking needs with a mobile banking loan application.

With QuickCredit, you can get up to 5,000,000 Naira at a 1.5% monthly interest rate with no additional costs. This program allows wage earners to apply for loans up to three times their monthly earnings.

There are no paperwork requirements for the quick credit loan application process, which is a straightforward procedure.

10. MoneyPal

Zedvance Limited has created a unique phone app called MoneyPal Loan. The fact that this software is user-friendly and transfers funds straight to the borrower's bank account has revolutionized the loan application process. Because MoneyPal is quick and easy to use, a lot of people trust it.

MoneyPal can assist you in getting the money you need for a huge dream or an urgent need. There is no minimum amount required and loans up to N5 million can be obtained. You have 24 months to repay the loan in manageable installments.

MoneyPal makes the cost of the borrowing very apparent. The annual percentage ranges from 34.8% to 365%. People can use this to determine if they can afford the loan.

If you want a seamless lending experience, go with MoneyPal. You can easily obtain the money you require and realize your dreams with MoneyPal.

It's probable that you may be asked for details about your bank account and BVN on the loan applications. You must be sure that none of the information you provide is false. If you want to avoid running into financial difficulties while working toward your goal, only borrow as much money as you are sure you can pay back.

A good credit score is earned by repaying loans on time, and this opens the door to future loan requests being approved for larger sums and cheaper interest rates. Furthermore, an early loan repayment lowers the total interest paid.

Before applying for any kind of loan, you should first make sure that you have carefully read and comprehended all of the terms and conditions that are associated with it. Your bank details should only be supplied in connection with loan applications that have already undergone verification.